Onchain Oracles: The Future of NFTs with SuperRare's John Crain

Interview with John Crain, founder of SuperRare, on the future of NFTs and onchain provenance—covering curation vs. decentralization, token/DAO governance lessons, AI’s impact on art and authenticity, and why Bitcoin Ordinals/onchain data matter.

Audio

Transcript

Contents

- STRATO Spotlight: Rewards Program demo

- Introductions and guest background

- What inspired SuperRare and early NFT history

- $RARE token, airdrop strategy, and DAO governance

- Curation vs decentralization and marketplace dynamics

- Future of NFTs: provenance, physical art, and certificates

- AI and art: tooling, authenticity, and signatures

- Bitcoin Ordinals / onchain data vs offchain metadata

- Closing and where to find John

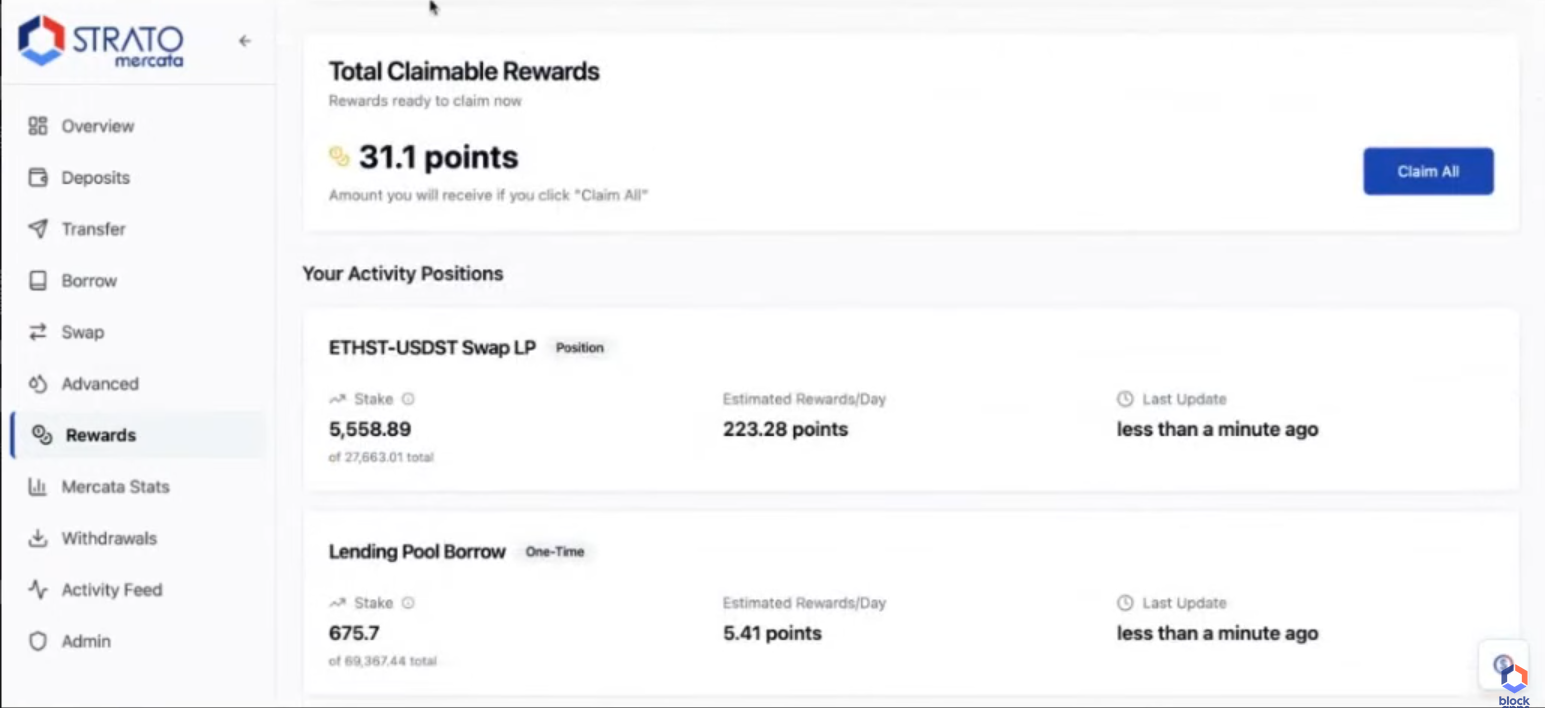

STRATO Spotlight: Rewards Program demo

[00:00] Victor Wong: OK, well, we have a special treat for you. Before we get into our regular scheduled content, we are adding a new weekly segment called STRATO Spotlight, where we highlight the latest and greatest features on STRATO. And for this week, we have a really special one. Kieren, why don't you announce it?

[00:18] Kieren James-Lubin: Thanks, Victor. So we completed our relaunch onto version 2 a little over a month ago, and wanted to monitor the system a little bit to just make sure everything was working well before we turned rewards back on. We have done that as of this Thursday, and not been loud about it just yet. We've been testing a little bit internally and it seems all good to go. So Michael will show you a little bit about what I'd call season one of our rewards program. Season zero was very successful bringing in about eight million of TVL. And we hope to see similar and greater results with the new rewards program. Over to Michael.

[00:48] Michael Tan: Hi, everyone. So I'm introducing the new rewards program. This page will be under the rewards section under the tab. You can find it here. This activities tab shows all the different activities people are doing in order to obtain rewards on the platform. Some are one time, such as lending from the borrowing pool here or just like making a contributing liquidity to the swapping pools as this person has done. We're going to start with the CDP mint. Go to advanced. Go to here. We have to first add a collateral to the vault. I believe this account has some ETHST. Going to deposit it. There you go. Deposited. We can borrow. I'm just going to borrow, let's say, 100 USDST. 91, rather. There you go. Then we borrow the 91 USDST. And that would be accruing rewards as a position. Next, we're gonna do deposit to lending pool. We have about, let's see, 496. Let's deposit 100 here. Great. Now we're going to do a swap, which is a one-time position. Let's do 100 swap assets. And add to liquidity pools. When you add to liquidity pools, it is an ongoing position. So then every time, as long as you leave your funds in the pool, you'll be accruing rewards. Turn deposit here. Great. And now we have the regular borrow functionality. Right now, I had deposited, I believe, two ETH earlier. So I'm going to just borrow a little bit here. And this will be accruing rewards ongoing also. Great. Borrowed. Now I just want to show you the My Rewards section of the page. We have this claimable section that you can claim at any time, there's no minimum, but this also shows your active positions, such as the lending pool position that we took, lending and borrowing, and any kind of liquidity that you contribute to the swap pools that I'm gonna claim here. And it's as simple as that. Back over to you guys.

[02:45] Victor Wong: Awesome. Thank you, Michael. And we should highlight for everyone, if you look at the activities, there's a long list of activities that you can do to earn STRATO points. And also, if you currently are engaged in one of the activities, for example, if you already have put some into a swapping pool or the lending pool, you have to take it out and put it back in to re-enable rewards for the system. Kieren, anything you want to add?

[03:10] Kieren James-Lubin: Just that this was on testnet, it is live on livenet. You'll see very slight differences when you do so.

[03:18] Victor Wong: Yeah, so thank you, everyone. Please start using the reward system. We'd love to give out lots of rewards to you in preparation to launching our full mainnet and making these rewards tradable in the future. So thank you for tuning in. Hope you use our rewards and tune in for more STRATO Spotlight segments in the future. Take care.

Introductions and guest background

Okay, we are live, and we have a very special episode today. We are talking about the future of art and NFTs, and we're joined by special guest and very old friend, John Crain. Welcome, John Crain.

[03:50] John Crain: Hey, Victor. Hey, everyone. Good to see you guys. Thanks for having me.

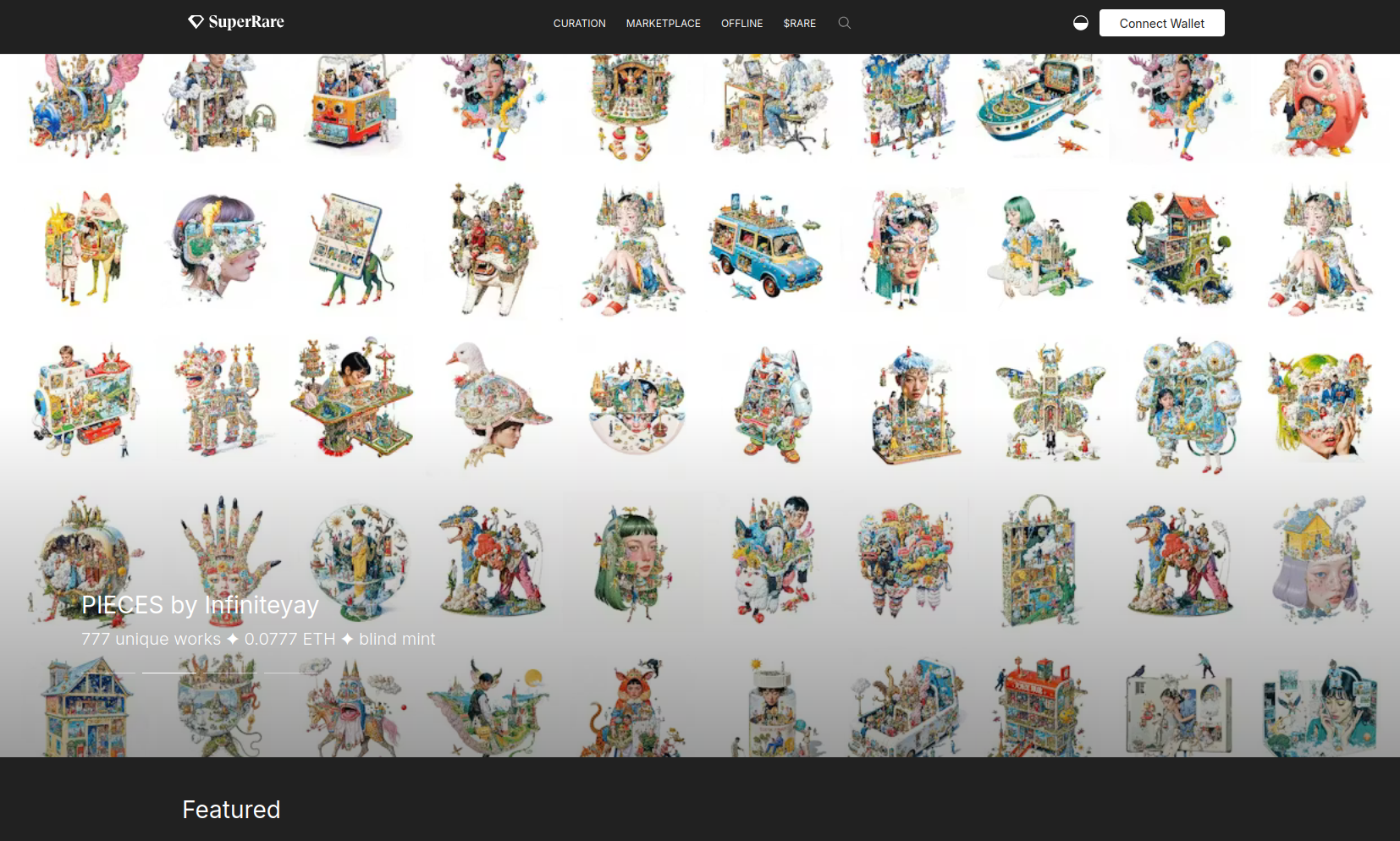

[03:54] Victor Wong: John Crain, of course, as everyone knows, is the founder of SuperRare. But do you want to give a quick intro for anyone who is not intimately familiar with all the amazing things you've done over the past couple of years?

[04:05] John Crain: Yeah, sure. So yeah, let's see, my crypto journey started in around 2015, going to the Consensus Hackathon where I met at least three of the other folks on this call there. Yeah, before that, my background was kind of in art and technology. I worked in advertising. I studied architecture and structural engineering for undergrad. And yeah, I was always really interested in when crypto and blockchain were going to intersect more with kind of the consumer tech and just things that were a little bit past finance and trading. And so yeah, when I saw NFTs, it was an instant win for digital art. And so I doubled down immediately.

[04:45] Victor Wong: Yeah. I remember how you heard about the hackathon or Ethereum generally. Obviously we met there, but like, what was that? Yeah. Well, your idea.

[04:55] John Crain: No, so I was kind of hanging out with the New York Bitcoin crowd. Actually yeah, I had actually met, I think John Lilic, which I forgot, but I met him at the like the New York Bitcoin Center. I don't know if you guys remember that.

[05:10] Victor Wong: Yeah, we do. Yeah.

[05:12] John Crain: Yeah. So I was hanging around and actually I was like, I was super into Counterparty. So I was very much like Ethereum is too complicated. Vitalik's full of shit. It's not going to work. And then the network launched and I was like, OK, I was wrong. Like, this is actually super cool. I have no problem changing. I was totally wrong, this is amazing. And I was just like googling Ethereum blockchain hackathon. I was trying to find, get deeper involved. I was trying to quit my day job and go full-time crypto. And so then I think I just googled it and it was like, oh there's this hackathon in two weeks and I applied with Charles and then yeah met you guys.

[05:52] Victor Wong: Yeah, and to be clear, to let everyone know that we were blown away by you and your brother Charles' project, and we gave you, I think, your first job, both of you in Web3, right? We gave you the…

[06:02] John Crain: Yeah, yeah, yeah, for sure. Exactly, yeah. I think the Monday after, I feel like I immediately quit and started working with you guys full-time on BlockApps.

[06:10] Victor Wong: Yeah, I think we tried to give you a job on the spot because you guys were…

[06:14] John Crain: Yeah, yeah.

Kieren James-Lubin: There was like a couple week consulting transition period while, you know.

John Crain: Yeah, I think that's true. Yeah. Maybe it was like we started like hourly, getting to know each other a little bit and then full time.

Bob Summerwill Yeah. So with Counterparty, you could have been on Chris de Rose tech?

[06:32] John Crain: Yeah, exactly. If only.

What inspired SuperRare and early NFT history

[06:35] Victor Wong: So what inspired SuperRare? I know when you were working with us, you kind of became our head of product and you were working on a bunch of those enterprise implementations. But what triggered you to kind of create SuperRare, which is for anyone who doesn't know, one of the first NFT platforms really out there?

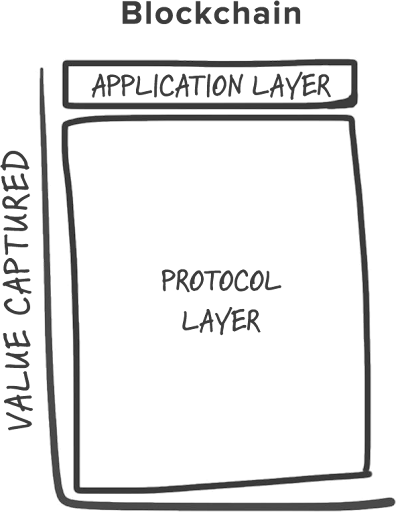

[06:52] John Crain: Yeah, I, well, I mean, it was super interesting, right? We were all kind of on the ground floor at the Consensus office, or like at least me and Kieren were hanging out there. And watching the ICO boom happen was fascinating. Cause I was like, I remember me and Kieren talked a bunch about ERC-20 tokens and like, I found it was super interesting that it was this very small bit of standard, a super simple protocol, very simple code. But like the adoption created this, there's massive wealth generation. And even if there were also lots of scams, I'd say generally net positive for humans in the economy. Like it was incredible to see that happen. And so then I saw some of the standards conversations around ERC-721 and I saw the CryptoPunks launch and I was like, well, this is pretty crazy. If you think about the consumer web, it's all an image and a title tag and some metadata. It could be that the entire consumer web turns into NFTs and that I don't know exactly what the business model is going to look like, but the total addressable market is probably pretty large. So that got me into NFTs. And then on the flip side of that, I was also kind of in and around the New York art scene, like going to the art fairs. I had friends who were looking for gallery representation and kind of part of the business of art. And it just seemed obvious. I was like, oh, there's now a way to truly own digital assets. And this is obviously going to apply to digital art. So it's kind of like the marriage of my interest in the tech side, but then also my interests and passions around art.

[08:25] Victor Wong: And like, what was it like to be at the forefront of the NFT explosion? Because you guys, like, I know for a long time you were building and it was like, oh, how's it going? And no one is really paying attention. And all of a sudden, next day, everyone's talking about NFTs.

[08:42] John Crain: It was absolutely crazy. It was hard to be like, it was just completely surreal the whole time. Like it felt like a dream. We started in 2018. We tried to raise money. It never really worked. By the time we raised, we were already cashflow positive and making more than we were paying ourselves. So that's the best situation to possibly be in.

[09:03] Victor Wong: Yeah.

[09:04] John Crain: It was like, it was a grind. It was super volatile. Many times I was just like, what am I doing with my life? But yeah, then it just really started. Like, I remember the numbers were doubling every month for a while. And I remember it was October 2020 was our first million dollar month in volume. And I was just like, this is wild. Cause 12 months ago, we were like, all right, so the volume was like $5,000. We made a couple hundred bucks. Okay.

[09:35] Victor Wong: Yeah. And were you guys the first self minting NFT platform?

[09:40] John Crain: I think like we're, we're trying to talk about that actually. Yeah, we were the first to come like, I think there were maybe a couple other minting tools, but we were the first to combine the minting and the marketplace experience. So it was like, there weren't great minting tools then. So we started with the minting tool and then we're like, all right, I guess people need a place to sell this. So we'll build the marketplace too. And it's partially just out of necessity cause like the tooling sucked at the time.

[10:08] Victor Wong: It's funny because I remember, if you recall, what later became the Flow guys doing CryptoKitties. They were based in Vancouver and I was talking to them about running it on our blockchain and doing that kind of stuff too at the time. And I mean, you've done so much. One of the amazing things is the launch of the Rare token. And you guys seem to be one of the first projects that was really committed to sort of figuring out DAO governance in reality. What led to that and how did that go? What did you figure out there?

[10:38] John Crain: Yeah, I mean, early on, I was like part of what got me excited about Bitcoin and Ethereum is just the idea of these networks where the users of the networks also participate in upside of the network. There's the Fat Protocol article that was super popular, like 2016. So just thinking about like, OK, what does monetization look like? And can you build platforms that are more like collaborative than extractive, where it's like, if you're Meta, you're just like, I'm just gonna extract as much metadata and sell ads, which is a great business, but partially for me, it was almost like a thought experiment of like, is it possible to build a network where you don't have to sell ads? And it could be like, maybe it's a marketplace as the business model. And then it's like collective ownership via the token. So yeah, I was drinking a lot of the crypto Kool-Aid at the time.

$RARE token, airdrop strategy, and DAO governance

[11:35] Victor Wong: Did you do it like classic ICO style? Was there like fixed price auction? How did the Rare get in there?

[11:42] John Crain: Yeah, we actually just did a huge airdrop. Probably one of our mistakes. Yeah. So we should have probably sold a bunch of tokens, but we actually just gave them away. And yeah, I mean, there's plenty of challenges to like, DAOs are hard to manage and run. But it's cool to see the current administration kind of change tack and actually seem like they're interested in building and pushing forward. So.

[12:05] Victor Wong: What do you think the biggest challenge was in running a DAO? Because I think all of us had that sort of as an ideal state with the crypto Kool-Aid, running things completely decentralized. What do you think are the challenges you faced when you did it and that are still out there, do you think?

[12:22] John Crain: Yeah. I mean, I think still one of the bigger challenges is regulatory. Like you have, you're kind of trying to read the tea leaves and then rather than just making the bet, you're like, okay, well, this is the simplest, best decision. You're like, okay, well, this is not clear what this means. So maybe we should do this. And like, how do we not get in trouble for trying to experiment. And it's obviously, the position is friendlier, but there's still no clear rules. It's like, obviously like the Gensler era of enforcement.

[12:52] Victor Wong: The dark ages.

[12:54] Bob Summerwill: Gary's going to be turning up for a job somewhere soon, isn't he?

John Crain: Yeah. Man.

[13:00] Kieren James-Lubin: Do you think of it as, do you think of it more like it should be like a representative democracy? Like should it be like passing bills in there? I think they're like, there's proposals and there's like delegation usually is the model. Yeah. It can also be like, just like you got a couple of leaders, but the stake could call a confidence vote or something. Or like people like futarchy too. I haven't tried it yet, but what's that? Like MetaDAO is trying to do that sort of thing. Yeah.

[13:28] John Crain: I think it kind of depends on specifically what you're doing. If it's something like, I mean, Bitcoin and Ethereum are obviously not DAOs, but just where it's like if small changes can have potentially catastrophic impact, I think that's one thing. If it's like SuperRare where it's like, if there's a low level protocol and there's application and other than the escrow contracts for auctions and things, the stakes are fairly low. I do kind of like the idea of if you can empower a team or a few individuals to kind of just keep going, and then the token holders can tell people to stop versus having to approve everything, that's a very silly, arduous process. And I feel like it should be more like, okay, if you're veering off in the wrong direction, there's a way to kind of raise your voice and influence it. Having a vote on what color the button should be or something is very absurd.

[14:22] Victor Wong: I'm curious, given that you're a decentralization advocate, how do you balance being a curated kind of platform and being open? How do you think about those two? Because I think one of the advantages of SuperRare with the curation side in art, you keep the quality very, very high, unlike more marketplace type NFT platforms which just frankly puts a ton of crap out there. So yeah, how do you balance those two and kind of keep decentralized do you think?

Curation vs decentralization and marketplace dynamics

[14:52] John Crain: Yeah, no it is, I mean it's kind of challenging. It's almost a paradox. But I think we've kind of always taken the minimal decentralization, so it's like you have it where it's useful. And then one example is like we were talking about token models early on, it was like maybe we'll have token holders vote on artists. And I was just like, that sounds like the most dramatic terrible thing I could ever imagine. It's like people voting, your art's terrible, you're like, oh my word.

[15:20] Kieren James-Lubin: I mean, in the pump.fun streamer heyday, I think that it could have really worked during that period of time. Yeah, you know, maybe we could have people stream. Yeah, it's like live going. Like, is the art good or bad? Watch this artist threaten to commit suicide.

Victor Wong: I did do stuff on a dating project once where you basically had to be voted in based on your photos, which just seems horrible. Yeah.

[15:45] Victor Wong: Very, very evil.

Bob Summerwill: But there's rate me out of 10 pages, remember those?

Victor Wong: Yes, yes, or Hot or Not or all of those. Oh, yeah, yeah. It's just brutal. But especially in places, the art industry can be quite vicious, right?

[16:00] John Crain: Yeah, it's challenging and good art is subjective. I feel like the on-chain auctions, escrow on-chain, that makes a lot of sense. On-chain voting for which artists are good, that's kind of like, let people who are making decisions do their thing. And then if it starts to be, if things get out of hand, maybe the token holders can raise awareness, but yeah. And part of it too, actually early on, we thought we would be more of an open platform. And then as things progressed, there were more tools. We were just trying, we were building things, trying to add value. And yeah, there's a ton of open tooling. So early on, we kind of thought we might have super rare as the ultra curated view into the market. And then maybe you have another kind of open platform that anyone could use. But I'm curious, like what was the, you know, it's a two side market with artists and art buyers. Like, what do you think, like, did you have to get the artist first to convince them and how did you do that? Or did you have to get the art first?

[17:02] Victor Wong: Yeah.

[17:03] John Crain: We, you know, you kind of had to get both first. So, I mean, we started just out of like, it really started as just me kind of experimenting and building. And so we were like, started with the minting tools. I was going around demoing, talking to people. And I guess we, it first kind of piqued interest of the artists. I was talking about how it would work. And then when we first launched, we kind of had, so there's Jason Bailey, who was kind of an early digital art advocate, big writer. He ran a company or runs a company called Club NFT that does NFT art backups. Yeah. And he hit us up and was like, hey guys, we'd been talking to him. And he was like, I know you're getting close with your product. I want to buy this art on Monday. Can I do it on SuperRare? And I looked at Charlie and I was like, do you, Jason wants to buy something on mainnet on Monday. Like, what can we do? That was in like 36 hours.

(Bob: Club NFT appears to be a dead project)

John Crain: Charlie was like, yeah, probably. And so then we basically stayed up for 36 hours fixing bugs.

Victor Wong: I'm getting flashbacks to when Microsoft said we want to launch blockchain as a service with you at DEVCON1.

[18:12] John Crain: Exactly. Oh my God.

[18:14] Victor Wong: There are many parallels. Nothing like a good deadline to get. Yes, exactly. Especially with a big partner that can make or break you, right?

[18:22] John Crain: So yeah, just don't have live demos on the end of all of that as well. Yeah, exactly. That's when it gets real risky. We actually, so when we did it, there was a funny bug with the React stuff. So we were like live, like helping, we were like live streaming, or not live streaming, but screen sharing the transaction with this artist Robbie Barrat and Jason. And we're literally pushing fixes. It was like, oh, we didn't know. I didn't expect that to happen. Like, okay, one second. All right, it's deployed. Just reload the page.

[18:52] Victor Wong: Lots of cache clearing. I remember about that.

[18:55] Kieren James-Lubin: I'm curious what you see as the future of just generally art and NFTs. Can I jump in on this? Yeah, please. Take a take on it. So in DeFi, we're starting to see, as the administration has cleared the way to some extent, it seems like there was a pent up demand for something like a TradFi DeFi merger. It's not all the way there yet, but it's getting to just be five. Like I see the path to that happening. Do you think NFTs really stay sort of like a distinct asset class forever? I know, maybe you could talk about your gallery. I know you started to do a lot of physical sales and like, does it kind of, what, do they merge? Do they not? Do they? Yeah, like trad art become NFT art and digital art or?

Future of NFTs: provenance, physical art, and certificates

[19:38] John Crain: Yeah. I, like the NFT stuff, I do think kind of just eventually fades into the background. The real zero to one is cryptographically secure provenance. So you could use that for physical art. You could use it for digital. I think it was more of a breakthrough with digital, because you can kind of argue the token is the art. You now have this more liquid asset. So for art specifically, yeah, it's kind of just becoming part of the market. And I think you'll see NFTs used with digital art, obviously, but also with physical art. Like no one's really, if you like, the lack of good data on provenance in the art market and collectibles in general is kind of amazing. It's still like, oh, there's a sticker on the back that says it was from this gallery. Probably it was. Probably it was? Nobody knows. And also, I think a lot of people are really trying to tie the physical asset to the digital asset, which I think is a waste of time. Personally, if you have the physical asset and you also have custody of the certificate of authenticity, that's kind of good enough. You don't really need some complicated tech solution there. And it's hard to imagine a world in which collectors and customers that you just want, I personally have a higher perceived value for physical art that also has an NFT with it. And I think in general, that trend continues. So I think digital art will kind of just become a bigger part of the contemporary art market. And then eventually we'll see NFTs used as certificates of authenticity for all high value objects.

[21:10] Victor Wong: Yeah, I mean, one of the big things I didn't realize is that a friend of mine is an artist and she often gets a request for the value that was paid for it because someone wants to insure it, right? And there's this whole downstream kind of economy. Insurance, appraisal, lending, you need much better.

[21:28] John Crain: And so it's like, I mean, Kieren, you and I have talked about the lending stuff a little bit. I think the lending market for these types of assets is small just because there's not good information. You could probably really grow that pie quite a bit if you do have easier access to provenance information.

[21:45] Kieren James-Lubin: Let me add a little on that front. So having been more of an NFT style RWA marketplace for a while and gone more DeFi, I thought that people wanted to tokenize to sell things at first, and this is true, but I think it is better that they tokenize to unlock liquidity. And selling could be one way, but people kind of want to hold on to stuff. Like I don't want to sell my ETH. I don't want to sell my et cetera. Yeah, you would know better than us at the very high end of the market. If you get a wealth manager, they might extend some credit against your Picasso, right? But for everybody else, and you probably have a lot of separate money for that too. You can't really, I don't know if people fire sell their art, but it tends to sit there. And I used to think that was bad, but maybe it should sit there, but the credit markets actually just make it liquid, as we've discussed before, which I think would be super cool. I'm surprised, or we're getting into that world, but we're not.

[22:42] John Crain: Yeah, we're seeing it. I feel like there's the green shoots of like, okay, here's what's possible. It totally makes sense. I think just like NFTs almost, they're a great, we've talked, a lot of people in crypto love talking about identity and stuff. And to me, it's like NFTs are a beautiful, very simple digital identity for whatever. You can pack anything you want in that metadata. It's just like a packet full of stuff. It's very simple. They're unique. They're pointers to one specific thing.

[23:12] Victor Wong: Yeah, I mean, I love the way you talk about NFTs as certificates of authenticity, because I didn't realize this. We looked into the physical art market for a while and every auction at Sotheby's when they have a big piece, they have to research it effectively from scratch, right? They have to build that entire chain of provenance with every piece that they do, which is an insane amount of work every single time.

[23:35] John Crain: Yeah, it's a very high friction process. The transactions are very, very high friction, which is good. Depending on where your position is in the market, obviously Sotheby's loves being the keeper of all secrets and information. But I think that's clearly going to be disintermediated with technology.

[23:52] Victor Wong: So, any new assets or maybe are you guys just declaring war on the auction houses? Houses, other high-end physical goods?

[23:58] John Crain: Yeah, I mean, we're focusing, our expansion, we launched the gallery earlier this year, offline gallery. It's on the Bowery right next to the museum. And we're showing physical, digital art, installations, projections, all sorts of different things. And yeah, I think our view, if you look at the models, the galleries are not doing great business wise, the auction houses are hurting.

[24:25] Kieren James-Lubin: Stuff is so illiquid, right? I don't mean to interrupt, right? It's just enormous stuff sitting five years, 10 years, and it's feast or famine. Like if we print a bunch of money, probably get a bunch of transactions.

[24:38] John Crain: Yeah, just wait. Yeah. Like 2021 people were just buying Picassos on their phones and crazy apes.

[24:46] Victor Wong: Crazy apes, right? Everything. Ether Rocks.

[24:49] John Crain: I remember when Ether Rocks were like the prices exploding and I was like, this is truly amazing. Yeah, I think the models have to change. And just if you think what the Internet's done as far as shopping, right? It's like you can price compare easily on your phone in any store, right? There's no kind of price arbitrage. You're going to look up the price of something, you can scan something, figuring it, ask ChatGPT, what is this? How much should it cost? And so I think the art world has really, it has been an insider's game of who knows who and what's the real price, the marketed price versus what was actually paid. And I think that's gonna slowly unwind and we'll end up with a market structure where pricing is just much more transparent. You can see things on chain. And I think that's kind of part of the opportunity is as the market becomes more efficient, we'll have the best tools to service the new structure.

[25:45] Victor Wong: So it sounds like even the big guys want more liquidity but they're not willing to let go of their proprietary information advantage, I guess.

[25:52] John Crain: Yeah, yeah, exactly. And that's kind of also the paradox. It's like you'll have more liquidity if there's better access to information, but it's the classic, what's The Innovators Dilemma.

[26:02] Victor Wong: The innovators, let me, exactly. I was like tip my tongue. Yeah, classic innovators dilemma. I think some of the auction houses are even trying to offer loans to try and lock people up even longer, right, to their places.

[26:15] John Crain: Yeah, they have, I mean, like they're all, Christie's inside, a lot of the big, or most of the auction houses are private. So I don't know how big their businesses are, but they do have, yeah, there's like people will inherit art and it's like they don't really care necessarily and their advisor was like don't sell that, you should just take out a loan. And so they do have them.

[26:35] Victor Wong: But that seems like a classic conflict of interest to your point, right, like we'll tell you how much it's worth and we'll loan you based on that.

[26:42] John Crain: Yeah, it's very one-sided and you can't really shop it around. It's ultra specialized information.

[26:48] Victor Wong: Jim, did you want to ask a question? You look like you came off mute.

[26:52] Jim Hormuzdiar: Well, it's a little bit of a different topic, but I'll throw it in right now anyway. What has been the effect for good or bad of AI and art on what you're doing?

AI and art: tooling, authenticity, and signatures

[27:02] John Crain: Yeah. As far as the startup goes, it's been great. We had a little robot on our Slack you can talk to that does things for you. As far as the art market goes, I think it's also been kind of great. In my mind, this is just a new tool that unlocks creative, you can do different creative things.

[27:22] Jim Hormuzdiar: You're encouraging it then.

[27:24] John Crain: Yeah. Oh yeah. We have tons of artists use AI. I mean, there's also tons of artists we work with who hate it and think it's the end of all creativity. I think just if you look, I think what it really enables is somebody to do more complex things. It's like where you can, all the grunt work you don't have to do. So now maybe instead of making one still image, you're going to do insane world building where you can go in, the art's just more interactive. And actually the first art we ever sold on SuperRare was kind of generated via GANs ("Generative Adversarial Network), like adversarial networks, voting on outcomes. So I think it's inevitable, it's gonna happen. It's kind of like digital cameras were the end of photography and they obviously were not.

[28:10] Victor Wong: Do you think going back to the metadata and certificates of authenticity that proving some part was based, done by a human will be valued into art or any kind of creation?

[28:22] John Crain: Yeah. I mean, I think, yeah, just if you, it's super amazing to see the rate at which content's being created and people, it's like, you can watch a video of like, that person didn't actually say that, but it looks like they did. I think that's where you're like, nobody ever answers a random phone number. If someone's calling you and it's not in your phone, you're like, I literally never answer this. I don't know who does that. You'd have to be pretty insane. It's sort of like you've kind of certified the numbers, and I think it'll end up being the same with content and art and stuff where it's like, if it isn't signed somehow cryptographically, you'll probably just assume it's fake because there's no real way to know.

[29:05] Bob Summerwill: Have you seen much interest on the Bitcoin side in terms of Ordinals and Inscriptions and STAMPS and Runes? How is that looking?

Bitcoin Ordinals / onchain data vs offchain metadata

[29:12] John Crain: Yeah, we've done a couple of projects on Runes with artists and yeah, it's super interesting. I think there's going to be art on many blockchains. Obviously, Bitcoin and Ethereum being the most secure probably have the highest likelihood of it lasting. But yeah, it's actually, people really like Ordinals. It's funny. One of the sort of paradoxes that are like the funny things we ran into is early on, we would talk to investors and they're like, you need to get rid of the wallet. It's too complicated. But actually it kind of ends up being this, like, you gotta know all the right terms. It's almost like you get the secret incantation, you get inducted into the club and you know how it works. And so like, I think people really like that Ordinals are a little more complex and harder to understand than NFTs on Ethereum. Which is just, yeah, it's sort of, that's a funny anecdote, but they're quite popular. I think they'll be around for a while.

[30:10] Bob Summerwill: And I mean another difference you have there, right, is that they're doing the data carrying on chain as well versus an external URL which is another interesting difference.

[30:20] John Crain: Yeah, yeah, totally.

[30:22] Victor Wong: I'm curious about the decision to, you mentioned starting the gallery and everyone's talking about RWAs and kind of bringing real world stuff into the blockchain, but you're kind of doing the opposite. What was the decision to start a physical gallery and why did you decide that was a logical next step for you guys?

[30:40] John Crain: Yeah. I mean, just, it's kind of part of how the market works. So people like getting together and a lot of the art, it's like, you can look at it on your phone, but if you see it on the huge projector, there's like a 10 by 10 CRT TV wall, it really looks different. So I think part of it is community building. It's a space people can show up. And then part of it's like the art really does just look different. So I think as far as, and after, you still, people are like, okay, these are just nonsense JPEGs, it's Ether Rocks 2.0. And so it's kind of telling the story to everyone else. Cause at the end of the day, it's still a demand constrained market and we're trying to grow the collector base.

[31:25] Victor Wong: Beyond art, what do you see as the next area? What's the next areas that are going to need these kind of provenance or these kind of certificates of authenticity? I can think of a million, but I'm just curious from your point of view, where do you see the next elements kind of getting into it first?

[31:42] John Crain: Yeah, I mean I think in general it's like luxury assets with, NFTs are still more expensive to create than not having one. You just print one out and then the ID lives in your database. Yeah. And I think but it's going to be like, the customers are going to have to demand it because a lot of the brokers and folks, they do their information advantage, so they don't really want this to exist. But I think it just makes so much sense. It's just hard to imagine that it doesn't happen. There's people taking wine very seriously, issuing NFTs and building secondary markets. I think part of it's an asset that's kind of fun to speculate on, but also you do like, there's a high likelihood you might have somebody send you the NFT. It's kind of like wine, watches.

Victor Wong: Handbags, I think are a big one.

[32:30] John Crain: Exactly. Yeah. Yeah.

[32:32] John Crain: One of the really popular ones right now is trading cards. So they're like…

[32:37] Victor Wong: What, people like, is Courtyard still going, right? I think.

[32:40] John Crain: Yeah, they're doing great. Yeah. It's, you kind of like you have the speculative aspect, but also if you're a serious collector, you can get real things.

[32:50] Victor Wong: Okay, last question for you, unless anyone else has one, but what are you most excited about in any aspect of the blockchain space right now?

[33:00] John Crain: Most excited? I mean, it's obviously, we've all been working on this for a super long time, but I do think if you look at even just BlackRock putting treasuries on chain with different partners, art's moving on chain, everything literally is going to, that is moving on chain. I think that's actually finally, it used to just be a mantra people would say to help themselves feel important, but I think we're finally getting there. We're like, holy, everything is moving on chain. That's actually happening. So it's like real world assets, digital assets. I think just, yeah, liquidity is increasing. I think it's generally net positive for everyone. It feels actually like it's finally happening, so.

[33:42] Victor Wong: Yeah, it's taken way longer, 10 years, but we're still here and we're still doing it.

[33:47] Kieren James-Lubin: We can make a thumbnail, like the Ron Paul It's happening! Exactly, exactly.

[33:52] Victor Wong: We need the Mission Accomplished banner.

Bob Summerwill: Oh my goodness, no.

John Crain: Yeah, exactly.

Victor Wong: Well, John, thank you for your time. And as always, we're really glad that you're doing so well. And where can people find you and learn more about all the stuff you do?

Closing and where to find John

[34:08] John Crain: Yeah. On X at @SuperRareJohn at @SuperRare. Yeah. You should also, there's currently a show at the gallery that's wrapping up, but we have a new, there's an XCOPY show December 10th. So if anyone's in town, swing through.

[34:25] Kieren James-Lubin: You said about a gallery one more time? I missed it.

[34:28] John Crain: Oh yeah, Offline by SuperRare.

[34:30] Victor Wong: Offline by SuperRare. Well, awesome. Thank you for joining us and take care, everyone.

[34:35] John Crain: Thank you. Thanks for having me.