Onchain Oracles: End of Year Wrap Up and Easy Savings

Year-end crypto recap + STRATO Spotlight demo of Easy Savings (bridge in stables and auto-deposit to earn yield). The team reviews 2025’s biggest stories/surprises/disappointments, shares STRATO’s roadmap, announces a SILVST giveaway, and closes with 2026 predictions.

Audio

Transcript

Contents

Introductions

[00:04] Victor Wong: Okay, we are live. Welcome to this week's On Chain Oracles. As usual I am joined. I'm Victor Wong, I'm founder and chief product officer at STRATO. And as usual I am joined with Kieren James-Lubin, CEO of STRATO and the man with the oranges Jim Hormuzdiar, CTO of STRATO from sunny California.

[00:32] Jim Hormuzdiar: That's not so sunny right now.

[00:34] Victor Wong: Have you eaten many oranges or are they just.

[00:38] Jim Hormuzdiar: There's a tree behind me.

[00:40] Victor Wong: Oh nice. Well, this week we are going to do our crypto year in review recap. But before we get into that, two quick things. One is at some point during the show I will announce a special giveaway and it's going to be a really special year end giveaway. But in preparation we recommend that everyone get a STRATO account if you don't have one already and join our Telegram because those will be two parts of it. And before we get into the URL.

[01:14] Kieren James-Lubin: For the to sign up.

[01:16] Victor Wong: Yes, thank you. It is STRATO S-T-R-A-T-O.nexus to sign up.

[01:25] Kieren James-Lubin: Yeah. And you can go straight to app.strato.nexus.

[01:29] Victor Wong: Yes, thanks Kieren. And then we are joined by Michael Tan today for our STRATO Spotlight because we have lots of new features to show. Michael, what do you have for us today?

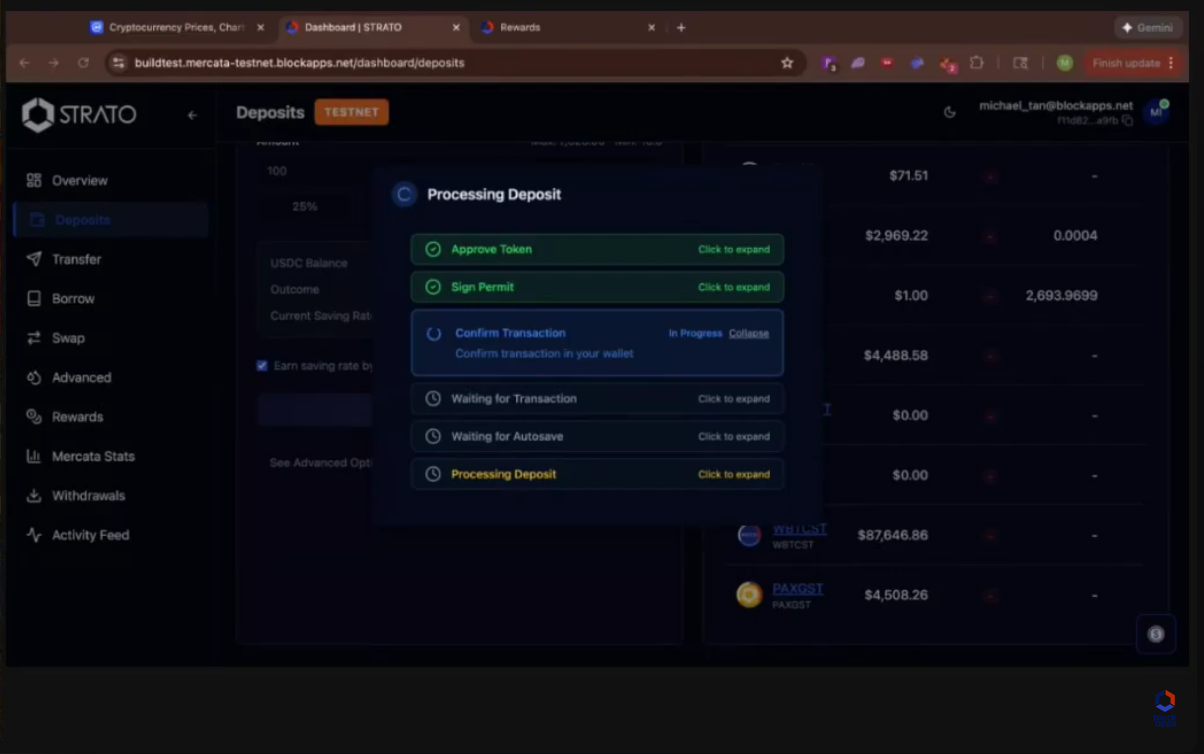

STRATO Spotlight: Easy Savings walkthrough

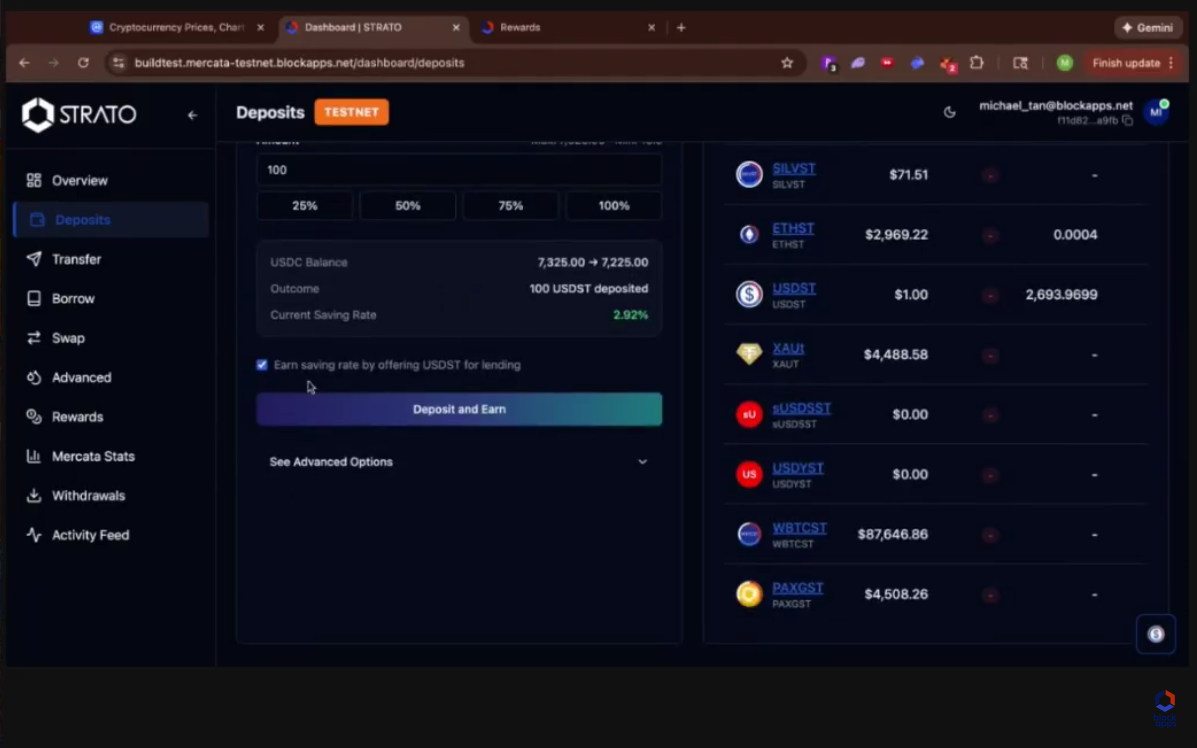

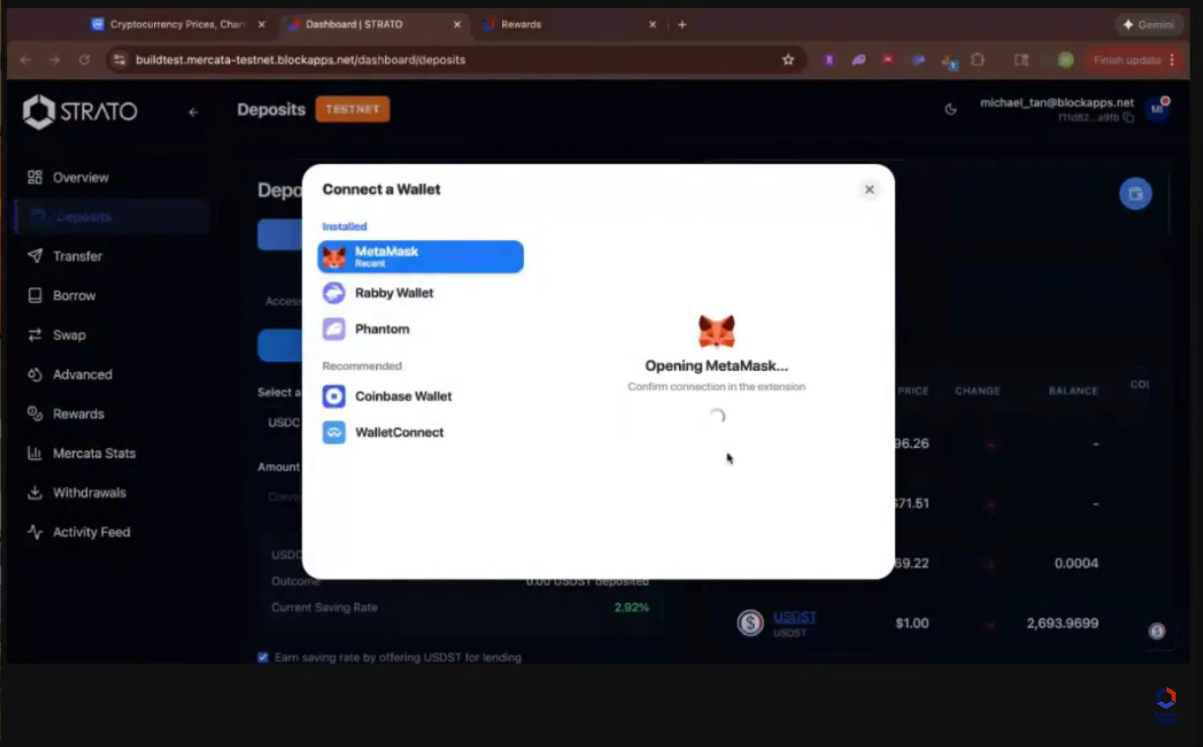

[01:46] Michael Tan: Hi everyone. I'm showing you guys the easy savings package path today. Basically it's bridging in. It's bridging in stables from Ethereum and saving them earning yield in the lending pool. So I start by connecting my Ethereum wallet.

As such it's a really simple process as long as you have it in the browser. My wallet is connected. I can pick between USDC and USDT. We're going to be adding a couple of different stables soon including yield bearing ones. Bridge in $100 here. Make sure this is checked so that it goes directly into the lending pool. We just added these cool modals but you just need to confirm everything.

Sign the permit, confirm the transaction. Why is it. All right, there you go. Takes a couple of seconds waiting for the all safe. Great. Now, now should be receiving the deposit one to two minutes into the. Into the lending pool. And that is your easy savings. Fastest and easiest way to earn money earn points on STRATO. And now …

[02:55] Victor Wong: So in the background what's. What's happening, Michael? It looks like we're converting from USDC into our local stables USDST and then putting it into the lending pool. Is that right?

[03:08] Michael Tan: Yep, that's correct. And you could do the same with USDT if you'd like.

[03:12] Victor Wong: Awesome.

[03:13] Michael Tan: And we also have a bridge out feature if you ever need that over here. But for now, this is the easiest way to get money in the lending pool and start earning.

[03:22] Victor Wong: Cool. And as everyone knows, we launched our season one reward program roughly two weeks ago. So how's that going, Michael?

[03:31] Michael Tan: Yeah, so we have quite a bit of points that have been issued. You can kind of check it here, the leaderboard, if you go to this tab. You can also go here to go directly to the leaderboard from the sidebar. But as it currently stands, looks like I'm number 13 on this. You can check out the different activities between in the network that are being done to earn points as well. The rewards here, these are your different positions are currently earning points. And this is my lending pool from Easy Savings.

[04:04] Victor Wong: Awesome. Well, you got bump up your activity to get up on the chart. Yeah, get to the top three soon. Well, thank you for joining us, Michael. And we look forward to the next segment. So with that, great being here, take care.

[04:19] Kieren James-Lubin: Thanks, Michael.

Crypto year in review: biggest story of the year

[04:21] Victor Wong: Okay, so let's talk about the crypto year in review. This has been like, when I kind of like reflected, I realized this kind of been a crazy year for crypto in general. And I think for us specifically, like, there's just been so much going on. So let's start with what you think is the biggest story of the year. And I'm going to start with Jim. Jim from your boat.

[04:49] Jim Hormuzdiar: You know, I want to push back a little bit on this one because I'm not going to push back. I'm going to answer the question. But I found this the least interesting of the questions because sort of by definition, the biggest story is the stuff that we've all been talking about nonstop all year anyway. It's the stuff that's been in the news. So it's just like my answers to this are just going to be boring and obvious. It's like in crypto in general. Well, sorry, it's at BlockApps the big story was that this was a development year. Like, we spent the whole year. We figured out what we wanted to do early on. We spent the whole year really making a great product and really only released it in the last few months. So that, that, that is the big story from us. In crypto in general. The big story was just the crazy ride that crypto took. It was like, you know, Bitcoin was down and then it was up and then it was down again. And I don't even know where it is today, somewhere in the middle of the year, I, I have this memory of seeing Eric Trump in Toronto introducing some crypto projects. So it's just, it's just sort of a crazy ride this year in crypto. So. But I will pass it on.

[05:58] Victor Wong: Okay, Kieren, what was your biggest story of the year?

[06:01] Kieren James-Lubin: Okay, so I'll quibble with Jim a little bit I think. I guess mine's a little bit a meta story. So it depends what you mean by big. Like I have a little bit of a philosophical objection to "news". "News" is always point in time and it doesn't really tell you trend. I think we would agree on this. And people that over index on the current and then under index on like what's really going on, you know. And the biggest one for me was that adoption and in price have continued to decouple. Like we started to see maybe 2023, 2024, that the supply of stables on chain it previously was correlated with crypto prices and it started to stop being being correlated with crypto prices. And stables on chain are at all time high and transaction volumes and stables doubled again between 2024 and 2025, I believe. I, you know, I asked the AIs this, they, they all said that. So at the same time prices are a little bit down from beginning of the year to end of the year. So this may just be how it is for a while. There's also other metrics like active wallets are up by maybe 10 million depending on the time interval that you consider. There are different estimates. Mobile's up 20ish percent. And also the institutions are clearly doing more than wading in. They're actually like quietly moving money with stables, especially around the world. And there's more of a kind of recurring institutional buy that's going on where crypto part of the reason it's been so volatile is that a bunch of very aggressive speculators are buying and selling rapidly. And if you compare stocks, the stocks that get included in the major indexes, quite often people have their send 500 bucks a month to Vanguard. And so that smooths out the volatility to some degree. And in let's say high, you know, medium to high market cap stocks.

[08:14] Victor Wong: Right.

[08:15] Kieren James-Lubin: That's actually a little bit starting to happen in crypto. And I think at some point you'll see some of the dapps get included in indexes. So that same pool of capital will start to flow into crypto. It's been friendly on the regulatory side, at least largely. You know, the US is passing some of the laws. The laws may not be perfect, but they're better than before. And also just the behavior of the regulatory agencies is far less aggressive, you know, far less, you know, arbitrary and capricious, if you will. And yet the prices are not up. So to me, this is okay. It might be a sign of maturity, but this is the story.

[08:54] Victor Wong: Well, I do think part of it might be that like the adoption from institutions and more mainstream things is sort of a lagging, like a leading indicator of where it goes. Like it's not like, you know, some big BlackRock announces some big thing and they turn it on immediately.

[09:11] Kieren James-Lubin: So, you know, maybe like it does feel like to me that most of the times the institutions are early and you know, retail price action comes later. You see that like funding private companies, you know, that you kind of, you, you need retail slash the public markets to get that next liquidity. Right. I'm not sure because there was a time, you know, when everyone had their stimulus checks and was gambling at home, you know, during the pandemic when like.

[09:47] Victor Wong: Like retail, everything, not just crypto.

[09:52] Kieren James-Lubin: GameStop, you know, era.

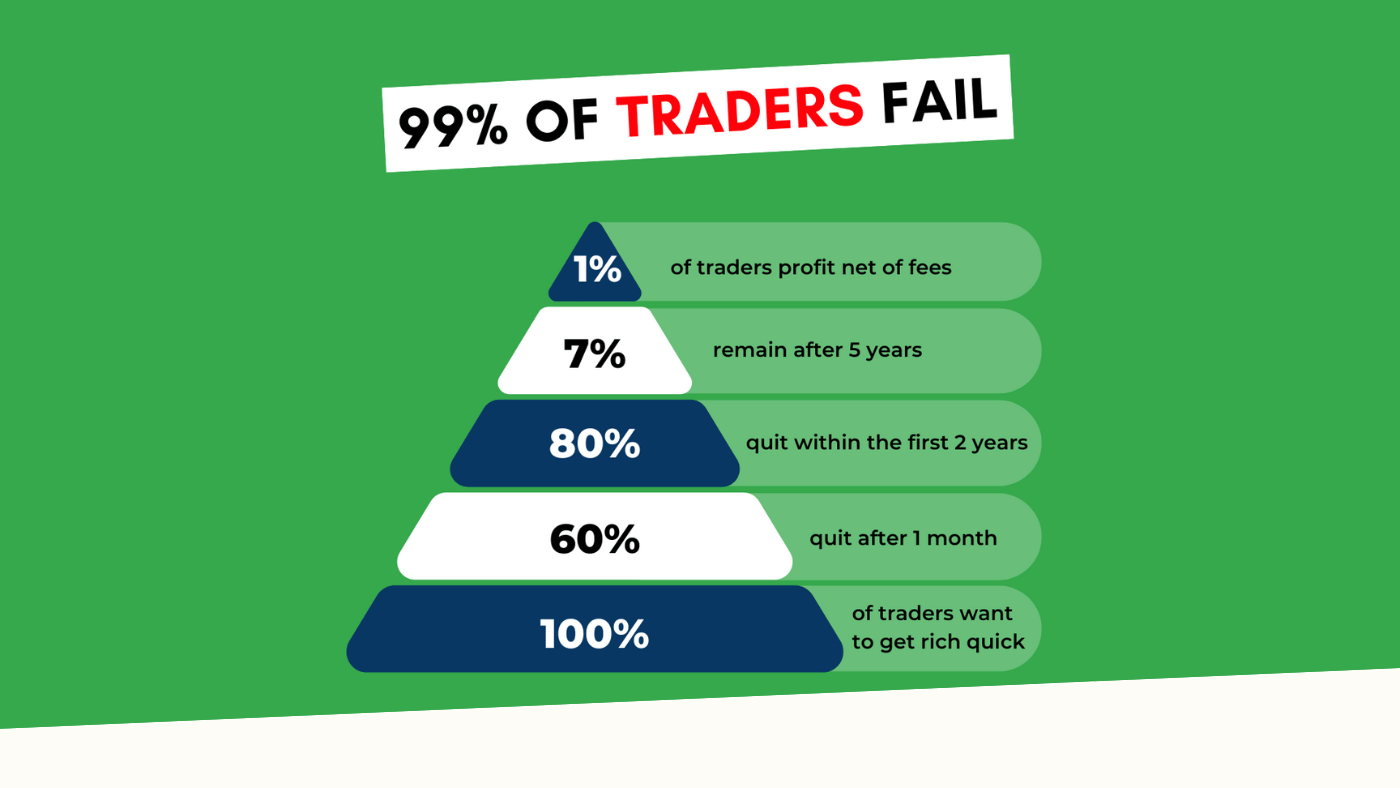

So I, I don't know what the trend I like now, I guess that was all stuff that was funded 2017, 2018 by you know, ICOs, which were a mix of institutional and crypto whale retail and and so on. So I don't know. I think the retail comes back, but it's a different form than. Than the last time. Like it you definitely, most people that trade in general, this includes stock day trading, something like 90% lose. And our. One of our employees is fond of saying 90% lose. And on average it takes 18 to 24 months for them to admit it and stop and just hodl or you know, in effect.

(Bob: That would be me, and I think it might actually be 95%. I dug up an article below)

But so we may have burned like a whole lot of people, but different ones will come in the future, I think.

[10:46] Victor Wong: So I'm, for me, I think the biggest story. Well, maybe I'll start with the crypto one and then just a general theme, right? The crypto one is the return of building that matters in the crypto space. And what I mean by that is I think in the previous year, you know, it was sort of the rise of meme coins, right. Like people were just kind of like marketing was winning the day. And it really was the people who kind of like could make a big splash or excitement in the market. And you know, I was kind of shocked when I looked at the timeline that like the $Libra coin was in February of this year. Like it feels so long ago.

And but like now you see the projects that are rising, like you know, like Zcash, the rise of Zcash, like projects that have been building for a long time and kind of really, really investing on the infrastructure side and even like the institutions getting involved on the infrastructure side like you know, Tempo by Stripe or things like Robinhood and doing their own too.

So I think as builders ourselves, I like to trend back toward building and I think that's a big trend this year. But I think part of the other trend which is in crypto directly related, is that AI has gotten really, really good and it kind of affects everything, but it certainly affects my day to day and I think our day to day ability to deliver. Right? So like, you know, like our mutual friend Steven Hsu, who just published I think the first theoretical physics paper that was like co authored by an AI. He describes AI at this point as like a super genius that is kind of crazy. Which, which is kind of like exactly the thing. Like yes, it does lead you kind of like on some odd goose chases sometimes. Like hallucination isn't over, but its potential to shortcut so many things is so powerful. Well, you guys …

[12:52] Jim Hormuzdiar: I think we're going through a phase right now in the last couple of months where people are sort of figuring out the limits of AI, which is a step in this because now that's going to bring us to the next stage. Like early in the year it just looked like it was magic and can do everything and now, and, but, but, but we knew it wasn't doing everything because you know, it hasn't taken over the world yet. But now we're sort of understanding what it is that it can do and can't do.

[13:19] Victor Wong: And even how to check kind of what it should be doing. Right. Like I think when we just took the outputs and we just assumed, okay, that those are okay, but like, I think it's like checking it. What do you think, Kieren?

[13:32] Kieren James-Lubin: Let me add an example. I've talked a bunch of times about getting back into writing code because the AI is so good and I thought that this applied mostly to the app layer of our stack. For those who haven't seen it, we have an app that lets you save in high quality assets, participate in swap pools, lending pools, all that sort of thing. It looks like somewhere between a DeFi app and it's definitely DeFi in architecture and a Coinbase style Apple application. And so the AI is actually really good at writing code in the app layer. But I didn't think so. We also have our own in house blockchain that we worked on for years, starting with being an Ethereum mainnet client, kind of forking off for enterprise use and then going back to being our own standalone L1. I didn't think the AI was going to be ready to help code in the really hardcore platform layer. But at least for simpler stuff, I discovered a couple of weeks ago that it can in fact that if I describe the thing you have to have is a good instinct for how the pieces work together. Like the peer to peer process is doing this and we see this in the logs and then the data is getting to the VM this way I still have all of that, but I can barely write the Haskell anymore. But I don't have to if I keep it pretty constrained. And this is like a surgical fix, not like a big rewrite I couldn't do or something like that. I could just describe what's wrong and what's probably right and it more or less gets it right. And I don't think it could do the Haskell six months ago, you know, it's, it's pretty good. Now again for surgical fix. It's not like really big stuff, but it's, you know, that, you know, each, each part of our stack getting more accessible to AI is a remarkable change. I'd also say, like, I remember when it was very good at net new code snippets but couldn't read a code base and now it can read a code base like maybe as of a year ago, maybe 8 months, 10 months, it can read a code base so much faster than I can that I just don't need to read the code base except line by line on a specific issue. Sorry, go ahead.

[15:52] Jim Hormuzdiar: So Stephen did say something in the podcast that until he said it, I kind of like was intuiting it but. But it really was like aha moment when he said it. Is that. So I've been wondering why, even though I have all these amazing tools, why sometimes I am not going a lot faster than I'm going and in fact sometimes I'm even slowed down. And he, he expressed something that he had experienced in writing the physics paper, which is the wild goose chase problem. These things know too much and they can throw out lots of great ideas and you can go off and just spend hours trying to research the ideas and you end up wasting more time researching all the potential good ideas. And you know, a lot of them don't pan out. Some of them do. Sometimes I learn like, you know, there's enough of a yield to it where I get some, like, lifetime tool out of it that it was worth it to do it. But. But I'm wasting a lot of time, like, just slavishly doing what the AI wants me to do. And I've gotten a little bit ruder with the AI lately and telling it like, that's a stupid idea. I'm not going to waste my.

[16:59] Kieren James-Lubin: But yeah, that also, it. It. Sometimes it feels like there's certain types of, like, attorneys or accountants or whatever, professional service workers who want, like, the belt and suspenders thing. Like, let me give the answer. That minimizes my risk as the professional services provider. Oh, and by the way, maybe cost the client, like, a lot of time and money, you know, I agree. You have to yell at it when it gets a little too. I don't know.

[17:29] Victor Wong: Yeah, well, and. And the. The thing is also, I. I think. Well, I think the thing with Steve that he also said, by the way, everyone should check out the latest episode on the Manifold podcast because he. He did the paper with the AI on physics, which I don't understand, Jim, you're gonna have to explain to me one day.

[17:48] Michael Tan: But.

[17:49] Victor Wong: But he also did another paper on how he did use the AI to write the paper, and that I found fascinating. I feel like we're entering what I call the centaur phase. There was this phase in chess with AI where the best chess players were actually computer chess engines combined with expert chess players. Right. And I feel like that's where we are now. Like, you need some level, like, you need to be an expert yourself to be able to evaluate the output of what the AI does. And you can't always just say, oh, like, the AI should know what it is.

[18:27] Jim Hormuzdiar: Yeah, but it's like the AI telling the master chess player to go off and play 20 games to, you know, try different things out or something.

[18:36] Kieren James-Lubin: The solution is ask the other AI.

[18:38] Victor Wong: To play things not clean. That's right. Like double check that thing, though, you.

[18:42] Jim Hormuzdiar: Know, you don't even have to ask another AI. These things are, like, myopic enough that if you just turn around and ask the same AI, sometimes it's like, very angry at its own first. What irritates me a lot is when it's like, here is a snippet of code for you to try out. And I try it and it doesn't work, and I come back to it, and the AI is like, you're an idiot for trying that snippet of code. Obviously it wouldn't work.

[19:12] Victor Wong: One area AIs have not gotten down though. It's like spatial reasoning. I did ask it to like come up with a design for like a box, you know, and give me the lumber that I needed. Like I just kind of grabbed the list, ran off, got it and then I came back and it was like totally wrong. Like I was like. And then when I looked at the diagram, it was like the wood had like overlapped with each other in space. You know, like things like that. Like spatial reasoning seems, it seems like.

[19:41] Kieren James-Lubin: You would need to train it on like a bunch of engineering diagrams or something. That's actually, you know, someone should do that. I'm surprised. Probably a bunch of people are working on it.

[19:52] Victor Wong: I'm sure they're working on it. And I think this is sort of in the space between the diffusion models and the LLMs. So I think that's where like you know and I know a bunch of people are working on kind of getting those. But I think, you know, when you ask the spatial relationship questions, you can be sent to one or the other and it sometimes gets confused. Okay, second big category, biggest surprise of the year. I'm gonna start with Kieren. What's that?

Biggest surprise of the year

[20:18] Kieren James-Lubin: Okay, so I thought about this. I have two part answer, slightly related one. October 10th, that was like, it was like a Friday. I think we had wrapped some work up. I was sort of like, I can't remember exactly what was going on. But then it just, everything just. Was it November 10, 1010. Right.

[20:41] Victor Wong: Yeah.

[20:41] Kieren James-Lubin: And then just like everything blew up. Like you know, you're up the next one. It's like whoa, like, like, like 20 billion. It was like the 20x larger liquidation than it ever happened before. I guess there's a lot more leverage in the system with Hyperliquid and, and all these. But sort of a perfect storm of circumstances and it just happened so fast and I guess, I guess all financial markets are like this, like things can just explode, you know, in an instant or all financial markets with the enough liquidity and derivatives. Right. But that was wild. I'm gonna add a related but you know, you know, on the edge. So metals are at an all time high right now. Yes, we like when we were starting to build out metals, we you know, acquired some for direct sale on our like version one marketplace. And like, like our average silver cost basis was like 25 bucks. 27, 29. It's like over 70. So like at least in the last day. I don't know what it's at right now. Gold also on all time high and crypto's down and it sort of shows. I've believed sort of this for a while, but, and I hope it maybe becomes not true in the future. Mostly crypto does not behave like a defensive asset. It behaves like a high beta tech stock. It's risk on, you know, so you'll see if you know, the, the major tech companies go down, Bitcoin goes down and, and vice versa, vice versa. It's not always true. I think Liberation day, we saw that happen for both and then crypto actually went up in sort of a. Well, you know, if they're going to restrict the movement of goods and they're not going to restrict the movement of crypto, it's hard to do. Why is it, why is this? I think it's just like it's the same type of people buying both and they see it as a future facing technology speculative asset.

[22:49] Victor Wong: I mean for, for a long time people have pointed out that if you look at crypto, instead of acting as a hedge against the stock market, it acts as more of a high alpha line of the stock market which rather.

[23:03] Kieren James-Lubin: The early on Bitcoin was totally uncorrelated with the stock market. But I think, I think probably started being correlated at least by 2020, but maybe even like 2018, let's say.

[23:18] Victor Wong: Okay, Jim, what was your biggest surprise of the year?

[23:22] Jim Hormuzdiar: So I'm gonna say the return of. Even though it never went away. And by the way, this might be recency bias because this has all been the last couple of months in my world, but the return of ZK into the, into the world. Suddenly about two months ago I started hearing everybody talk about it again. You know, like we, the, when we were down in Argentina a lot of the talks were about that board meeting. People were all asking us, what's your ZK strategy? You guys all of a sudden got really interested in the Zcash client that I, that I had worked a bit on a couple years ago. It looks like it's probably real right now because there are certain applications that are actually working, although I won't say which, but I went to a bunch of talks in Argentina that clearly were vaporware. Maybe that's even generous, like things that didn't make sense to me. But there are a couple of applications and the scaling application that I guess will probably happen in Ethereum could be big.

[24:33] Victor Wong: It's kind of exciting. Yeah, I mean like if you look at the trend lines, it's crazy. I think like last year to do a proof for on the like Ethereum blockchain testnet, it took like a computer with like 48 GPUs and then now it's down to 4. So it's like really accelerating. Yeah, I, I'm not sure why that's happening, but it, it does seem to be positive.

[24:57] Kieren James-Lubin: I think many things are true at once on the why this is speculation, but one like the EU came out and said like, oh, you're going to need a driver's license to use the Internet. And this like scared the crap out of everybody. And we're like, you know, we weren't taking the privacy thing is like we just wanted to pump these prices. But like, you know, are they gonna like, like I gonna need to like put my fingerprint for my computer to turn on? Not. No one has suggested that yet, but like, so the, you know, the cypherpunk fundamentals kind of have come back into the focus as like at least visibly, you know, governments seem to want to, you know, reassert or assert control over the Internet. And yeah, I think, I think the privacy people were here in backgrounds. We went to the Cypherpunk Congress at the beginning of DevConnect and like, clearly these people had just been there for 10 years. We kind of forgot about them and they're just still there. But as a meta, like, you know, like the Zcash price went crazy. I think definitely some people were trying to find a way to like rotate out of something into something else without making it look like they're selling the thing. And you know, but it's, it's also, I, I think, yeah, maybe also like post meme coins. There was sort of like a value rediscovery going on, you know, in that like even the kind of more extracty crypto types seem to have some cypherpunk inclination. Not always. There's a lot of new entrants that are more like the Wall Street personality, but I think some mix of organic and manufacturer got. And then the price action got. Got everyone thinking about it again. One thing that occurred to me as I started researching privacy again because we spent lots of time with it both in our enterprise days and then subsequently we were kind of trying to figure it out before mainnet launch, which is why Jim built most of the Zcash client and then we kind of dropped it for a while. But part of the reason it came back for me is that it also seems more viable. Like there's a bunch of competing Ethereum ecosystem privacy products like Railgun privacy pools and so on. I guess Roman Storm was in the news a bunch during the year. Roman Storm of Tornado Cash, of course. And I didn't realize that it like kind of maybe basically works and it. It sort of didn't. Like Zcash also had added, like they've got a mobile wallet now that supposedly just works.

[27:42] Victor Wong: Yeah.

[27:44] Kieren James-Lubin: And it's easy to shield. It wasn't easy to shield before. So some like, perfect storm of factors seem to reignite the. The privacy thing.

[27:52] Victor Wong: Well, I think part of it is just people realize, you know, as maybe a new kind of mainstream adoption is taking place, people are realizing, oh, crap, my balances are in fact public.

[28:08] Kieren James-Lubin: Yeah, there's a wrench attack per year, per week in 2025, something like that.

[28:14] Victor Wong: Yeah. So, like, I. I think, I think too there was an assumption that my balance is worse yet I think for mainstream audiences. And, you know, now they're not. So, you know. So my biggest surprise of the year was really the Robinhood announcement. And it wasn't that Robinhood was doing stuff in crypto like we knew that forever. Right. But the kind of many things they announced at the same time, you know, their own L2 that they're putting that they had their own tokenization engine that they were doing secondary stocks and kind of like pushing it out immediately. I think it got like everyone really interested and excited. Like, I think that sort of put in the arms race of institutional adoption. Right. Like, I think that kick started it and it was surprising because like, you know, like we're on the board of the Enterprise Ethereum Alliance. We talked to. We have a lot of connections with enterprises still, even though we're out of that business. And, you know, it caught a lot of those companies off. Like we. We had conversations with a bunch of other companies or like, like explain to me what Robinhood is doing, which is kind of interesting. Okay, next one. We never like to talk bad about anything, but. What was your biggest disappointment this year? I'm going to start this one off. I think like I mentioned before, Libra was this year, it was February this year. It was kind of shocking. The level of interest, manipulation, like when the whole story came out, you know, that something could get effectively to the presidential office of a government, you know, in order to do that. So in that way was kind of shocking to me. I know, Kieren, you have more pro meme coin than me. But like, it was. It's sort of, I think, you know, on the good side, it seemed to be the death knell of meme coins. So I think even though the actual incident was pretty disappointing from my point of view, it did kind of like the consequences, I think put the industry in a much more positive direction. What do you think? What's your biggest disappointment?

Biggest disappointment of the year

[30:35] Kieren James-Lubin: So I'm gonna mostly agree, but with the different take, I'd say the nature of the meme flame out, like, you know, I think I'm sort of like excited about all of the, you know, the, the activity and the government kind of getting pro crypto in the US in the Milei revolution. We'll see. You know, but the, the way, I guess it takes a certain amount of expertise to like embrace crypto the right way or a certain level of non cynicism or, or something like they could have just hodled, you know, like. But yeah, I think the, in principle, there is no reason that meme coins have to be a pump and dump vehicle.

[31:25] Victor Wong: Right.

[31:25] Kieren James-Lubin: Like, you know, some people say Bitcoin is the original meme coin. Yeah. And Doge is just still here and big and still kind of funny, you know, and like pump.fun, I guess. Just sort of so strongly orients the economics of the system. And you know, I'm not saying it's anyone's fault for participating in it on either side, launching the meme coins or, or buying and selling the meme coins. But you know, again, 90% of people lose. It's mostly about timing. You got to just know when they launch, buy them really fast, sell them right away. And this is like a reliable way to make money, you know, from some group of gamblers who eventually, then they haven't totally stopped, but will eventually stop playing in this particular casino. And it's like, it doesn't need to be like that. I think, you know, I think Base tried to rebrand them to like creator coins, you know, but like most, a lot of the problems in, I don't know, incentives are about timing, right. Like if you just forced some sort of hold, then like, like if the meme coins vested, maybe it would be fine, you know, but we're just dumping them on retail. And so like, you know, NFTs had a phase like this. Some of them will kick around. They kind of came back in a rhyming way as meme coins, which were even more. Much more liquid, you know, and able to like trade concepts. And you know, I've said before, I see there's a sense in which meme coins are like the flip side of prediction markets. They're just a measure of what people believe. But the design is bad from like a market structure perspective as and as a norm. It's like everyone opted into this, but it still kind of looks gross when you look at it.

[33:24] Victor Wong: Yeah, I mean I think it's the difference between a speculator versus a builder mindset. Like we know takes time to build stuff, right? Like you, you know, building audiences, building, you know, products building. It just takes time. AI has sped that up, but you have to invest that and have that longer term outlook. Okay, Jim, what's your biggest disappointment of the year?

[33:46] Jim Hormuzdiar: And I'm going to assume you're not talking about, you don't want me to talk about the fact that crypto coins didn't stay at an all time high for forever. And at some point.

[33:57] Victor Wong: You know, I, I had to tell many people like, like, hey, you know, now that we have to manage our treasury and this is going to go up forever, I'm like, wait a second, it's not gonna go up forever. Nothing ever goes up forever, you know.

[34:14] Jim Hormuzdiar: Like, well, I'm gonna go a little bit more myopic look in the development of our products and sort of treat it as like a lesson maybe. I think that my disappointment was various features that we had put into the product that were sort of an extension to Ethereum and we do have some good extensions to Ethereum that we're keeping in there, but various parts we sort of had to pull out. For instance, we had taken identity, turned it into a username, built a lot of security around that. And then turned that into a first class citizen so that it wasn't something built upon it. We sort of had to pull that out because we realized we have to, especially with the new direction of the company. We have to really integrate with things that are out there. So even something like using a wallet became hard when the first thing you have to do in the wallet is have the address database and I'm like, well we're not really based on addresses and so some sort of cool things were pulled out. But the important thing is I think realizing that there is a whole ecosystem out there and we are part of that now and we have to stay within the parameters of that ecosystem.

[35:40] Kieren James-Lubin: Let me add so many. No one really loves Solidity. People are probably almost instantly on arrival were unhappy with the ERC-20, you know. Yeah, yeah, standard. Someone who like maybe worked on it if Bob would have to tell the story but like instantly started dedicating his life to trying to move to a different standard that's mostly the same but better gets rid of the approves.

[36:12] Jim Hormuzdiar: And I'm on the record for saying that I, that I'm very pro UTXO vs Merkle Patricia for data. But yeah.

[36:21] Kieren James-Lubin: Likes something UTXO flavored better. Including me. We're just stuck somehow with the ERC-20. It's like. It's like the COBOL era Solidity and ERC-20 is the COBOL of the. It's going to be here. People keep trying. I mean, Solana kind of made Rust smart contracts work. But that's like the only other example really. Everyone goes off and invents some UTXO thing because it's like much cleaner conceptually and then the devs don't use it and it doesn't integrate and so on. I guess I would say partial exception with some of the privacy tools, but it's built on a. The ones that people use are. Have like a base of ERC-20 or Zcash.

[37:12] Victor Wong: I mean, yes, but like it's one of these things where like every developer always wants to write like they're like these. This language is terrible. I'm going to write my own language. It's going to be so much better. And no one ever uses that language. Right. Like it's like. Yeah. Where. Whereas what actually happens is people make JavaScript much faster.

[37:34] Jim Hormuzdiar: Kind of have like an internal joke because I won't mention any names, but we had a developer once who we assigned some years ago. It was like 15 years ago.

[37:45] Victor Wong: We assigned this. The last. The last company we worked on.

[37:49] Kieren James-Lubin: Last company.

[37:50] Jim Hormuzdiar: Yeah. We asked him to do task A and he was like, before I can do task A, I have to rewrite like the language and create a rules engine that would be used so that. I don't know. So we always use the phrase rules engine whenever somebody wants to go out and build it. But it still was, you know, like it's one thing to be able to. To build cool new additions. It was a little sad this year to actually have to sit there and rip out cool new additions.

[38:18] Victor Wong: Yeah.

[38:18] Jim Hormuzdiar: To be compliant.

[38:19] Kieren James-Lubin: So we'll add more in time.

[38:22] Victor Wong: But it's funny that in many ways we got back to. To basics like in. Not only from the tech, but even in branding. Right. We went back to our original STRATO name, even though we had been kind of like adding over to it. And that, you know, takes us back 10 years. So. Okay. STRATO update and roadmap. So, Kieren, I looked back at this. I think at the end of 2024, our TVL on STRATO was slightly less than $100,000. It is currently about over $9 million.

STRATO update and roadmap

[38:58] Kieren James-Lubin: 90X in the year is pretty good.

[39:00] Victor Wong: Yeah. Yes, exactly. Can you give a quick update about what's happening with the project and any things that you want to let people know to look forward to in the coming year.

[39:12] Kieren James-Lubin: Yeah, well I think at the top level we're trying to make the thing useful and popular. So see it's tricky how to measure that. Right. But you know, more TVL is a good proxy. The thing is generating revenue now should generate more. You know actually like the CDP and the lending pools are just like, you know, there's just a little bit of interest accruing every day for the protocol. It's like whoa. And the swap pools too. We'll see lots more assets. So at the moment we've got sort of like four first class assets and then LP tokens of different types including our native yield coin which is driven by our lending pool. There'll be lots more so from tokenized stocks where third party, these are all third party issued and you know, if they're available within DeFi we can kind of copy and paste over the terms and conditions and you know, people can choose to use those third party yield coins all manner of. So we'll also be releasing things like. So we've got first party gold and silver. There are a couple good gold coins. There may be one good silver coin out there releasing things like stable swap pools so that you certainly can go drop your metals off in the vault and you can pick them up. You can exit within our system by swapping to say ETH or our stablecoin and withdrawing but you could also go swap to other crypto as well so that for convenience sake it's easy to get out and it helps support the price within the system. Another yield source we're thinking about, we found that not only do you need swap pools for people to be able to put liquidity in and being able to trade, but you actually need to monitor those swap pools all the time. It's quite easy for the implied pool price to differ from the spot price of the asset or the ratio of the spot prices of the assets. And so what you try to do then we. We ended up writing a little trading bot that just watches the pools and then kind of sort of it does an arb in effect but it resets the price back to to spot. I realized there's some platforms like Lighter Hyperliquid maybe, maybe first where they set up vaults that in essence trade against the other users. It's not like, not in a, you know, extractive way but in a make sure there's someone on the other side to do the trade. So like if there's a big trade on a swap pool, let's say it moves the price 1%, then there's an arb and the bot can put the price back 1% realizing a profit in the, the, the process. But if you imagine actually the same people put into the LP and roughly equal amount into the bot, then kind of arb loss canceled out and it converged to hodl, but there was a fee that came in. So for folks who want to, we're trying to, you know, you don't really want vicious arbitrageurs taking up the arbitrage op. If you can give it back to the users, that's, that's a. So more ideas like that. We've also got, you know, like we've not had any liquidations on system yet. I hope not to have many. I'm sure they will come someday. We try to encourage pretty low LTV borrowing, but that, you know, similarly we could have pools that cover certain types of like, you know, like we don't have a liquidation bot yet, but if we have to, we could have a pool for that, for instance. So that kind of the money goes back to less predatory hands. So yes, more assets, more yield. Privacy we're serious about. We've, you know, the meta may be forgotten by the time we ship our privacy stuff, but Jim has been looking hard at how to, you know, incorporate some of the knowledge that's in his head and some of ours and in the ecosystem too, with what we're doing. It does look. So we've been like, we've tried to like install a bunch of the privacy tools and they just like, they barely work. They work, but you really gotta cajole them into, you know, and so if you could provide an experience for like an end user that's kind of default private but easy, you know, like I think, I think consumers need to be opted into privacy by default and that they should have to opt out explicitly. That's kind of the guarantee you get from a bank or exchange, right? It's just private now. The bank knows everything about you and probably, you know, reports it to whomever, whichever authority and, and so on. But otherwise, you know, exchanges have always been like the poor man's mixer, right? Like there's kind of just one account. The exchange is a big slush fund of assets with a off chain claims on them. And so if you're trying to not let someone know your real balance, you just put a little on an exchange and take it out. Right? And you know, we, we want the world to be more the DeFi way. DeFi is super transparent and it actually does seem viable to do at least a subset of DeFi with privacy. This is sort of what Railgun and some others have shown. But the devil's in the details. It's not at all easy. Yeah, so it'll be a big one. And kind of the last category is like, I don't know, consumerization, like getting easy on ramps tied in like actual on ramps. But exchange listings for some of the tokens say so on and so forth. More bridging to external chains. Things like having a credit card wired up. You know that there's a bunch of products that have that today and we're actually thinking about trying to integrate with them as opposed to like issuing our own. I like a degree of indirection from the legacy system. So if you take US dollars into a bank account and then mint stables, it's a big complicated business. But if you just take USDC, it's, it's, you know, the USDC settlement is more or less final and there's much less, you know, like the person canceled the credit card payment but crept your crypto risk there. Trying to kind of work with others in the industry to produce a complete end user experience but also keep it like in the on chain much, much longer term. We want to kind of fill in the suite of services people expect from financial institutions like you know, unsecured or under collateralized lending and so on. But probably that won't be next year, but we're definitely going there. You should just be able to live your whole financial life on chain. One more thing, you know, we've been trying to make it very easy to get new users on board from like a phone interface. Like one of the brilliant things about PayPal, Venmo, etc is that you could pay someone who wasn't in the system yet so long as you had some kind of contact info for them. So I, I still. You barely see this in the crypto world. I've not seen much in the way of like, you know, like texting someone money. But we'll roll something like that out soon and not too long. So it's kind of two axes keeping cypherpunk, making it, you know, easy and feature complete.

[46:53] Victor Wong: Yes, like bringing, bringing cypherpunk power to, you know, the normal grandma eventually. Yeah, you don't have to wear, you know, you don't have to wear like.

[47:03] Jim Hormuzdiar: Like.

[47:06] Victor Wong: To get to have some privacy. I think people are realizing that like that should be an expectation to a certain point. Right. I do think the right thing about shielded balances, like you don't have to protect everything, but you have to protect certain things like how much you got.

Year-end giveaway

[47:06] Victor Wong: Okay, before we dive into our 2026 predictions, I want to announce our giveaway. Tying into Kieren's thing about metal. Prices are way up this year despite crypto. We want to take away some of the crypto down paying by doing a giveaway where we give away three of our silver tokens. So each silver token is equivalent to 1oz SilverST and to enter into this, it's a lucky draw. You have to put your Mercata address on our Telegram and we will pull three lucky winners from all the addresses we get and we will send them one silver ST equivalent to one ounce of silver. So hopefully that will be a nice holiday present for a couple people and we hope that you sign up as quickly as possible.

2026 predictions

[47:06] Victor Wong: Okay. With that, let's go to predictions. Jim, what are your predictions for 2026? Okay.

[48:24] Jim Hormuzdiar: My prediction is that this will be the year of usability. It has to be. There's so much riding on, there's so much good technology out there right now and there's so much riding on who wins this. And so many of these products which are based on something very solid just can't be used. I won't call out names, but multiple times this year Kieren might come to me and say like, here's a really cool project, go use it. And then I would waste days and days just trying out to do the most basic things with it. And I know how this stuff works.

[48:57] Victor Wong: Internally and you wrote a Zcash client so like you can't do it. Who can do it?

[49:05] Jim Hormuzdiar: So I think there's going to be a lot of pressure to make these things just work. And we've sort of hit a point where there's always stuff to add, but the basic stuff is out there and it works right now. So there's got to be a lot of competition and we're going to be part of this for sure to make this stuff as easy to use for the end user and just work.

[49:27] Victor Wong: Okay, I'm going to go second and leave you the last Kieren. My prediction is this year of ZK scaling and institutional crypto adoption. But it's going to be slower than people think, at least from the adoption side. I say that because we have worked with a bunch of big enterprises and governments in our history at STRATO and even when they do some giant ass press release, it all moves at some glacial pace. So I think we're gonna see some traction and making that more real, but it's gonna move a hell of a lot slower than everyone on crypto Twitter thinks. But I do think, like I said, like I think the first kind of shooter drop in the world of ZK is going to be around ZK scaling and I think we're going to see huge improvements on this year. So Kieren, what are your predictions? Bring us home.

[50:25] Kieren James-Lubin: Okay, so I predict, and it's not unrelated to Jim's, a continued DeFi TradFi soft merger where you'll see TradFi capabilities in DeFi. You'll see TradFi using DeFi rails from stables and into more sophisticated stuff. Something remarkable. Like in some ways like you know, Aave is like the federal funds rate of, you know, like the USDC borrow rate on Aave is like kind of the benchmark for you know, sort of low risk borrowing in, in crypto and that's remarkable. Like everything else in the world just instantly reacts to what, what the Fed does and maybe crypto does too. The prices certainly do. But the stable borrowing markets, maybe it's, it's a little bit indirect. And so I think we should see some level of continued boringness. And that boringness is probably a good sign even though like we want good excitingness, you know, at, at different times, I think. Yeah, so, so in that, in that category, stables keep going up in supply and volume. RWAs continue to get bigger. We saw a big run starting the year in, let's see, like PAXG and others. Obviously our RWAs are way up in circulation as this, this year goes on. And part of the reason is just like even dollars don't solve inflation in total it's much better if your option is, or at least until recently probably still the Argentinian peso to hold USDC, let's say. But this year gold, silver would have been better or Treasuries are better than just dollars for instance, I think. Well, we just for practical reasons you need, the world is priced in fiat at least you know, for now and may continue to be. So you just need a mix of things. You know, go, go along with your crypto but also hold some other stuff so that day to day you're not in trouble. I also think related to Jim's point, the way I wrote in my, my little notes here is that value capture will keep moving up the stack. So there was a time where what you did was write a 60 page technical white paper, maybe you were a professor or something, raise like 50 to $250 million on chain build some complex blockchain. Sometimes they worked, sometimes they didn't. And there was like an L1 premium and even an L2 premium. Like, you know, having control of the infrastructure makes the token go higher. I think there's still a little bit of that. And we ourselves are an alt L1. And in part it's just like you inherit a lot of, I mean still a lot of the assets primarily bridged in from Ethereum. That's like the only real big source. And you know, we have small integrations with Base and all that sort of thing. But you know, I think the reason really we did it is to be able to deliver a better app on the top end. And so you'll see most of the value capture will start to be just fighting over users as opposed to more abstract infrastructure promises, throughput, cheaper transactions and so on. I think the market is mostly moving away from that. There are still some, but it's again like the Lighters, the Hyperliquids, Linea recently are fairly high in the stack. You know, like there's a big anchor app at a minimum for all of them. Perp DEX, the Wallet, you know, various other apps on Linea. And it's a short list of successful L1s, L2s. You know, Polymarket is on Polygon. I think that's a coincidence, but it's kind of funny. And that's the thing that really keeps the alt chains going. Of course you try to get implementations of all the major protocols on there. But yeah, so I agree with Jim. It's about the usability but. But yeah, in a specific sense, like we gotta actually just get people to live their lives in, in this thing.

[54:59] Victor Wong: Yeah. The way I think of it is kind of adoption over research. Like, you know, I think when we started all the big new chains were effectively like research projects. Right. Like there were big ideas and things that may or may never be delivered. And now like really it's about, you.

[55:15] Kieren James-Lubin: Know, they're kind of like deliver the whole thing before the TGE now.

[55:18] Victor Wong: Yeah, exactly, exactly. Well, with that, thank you very much for joining us for our year in review recap. I'm Victor Wong, you can find us at strato.nexus and we hope you have a happy holidays and please sign up for our giveaway and enjoy some vitamin C and sunshine. At least Jim is. Take care.

Closing

[55:44] Kieren James-Lubin: Thanks everybody. Happy holidays.